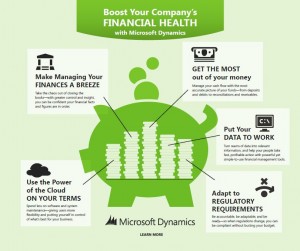

5 Tips for Healthy Financial Management: A Recap

Over the past month or so, we’ve taken a look at 5 key things an organization can do, right now, to ensure their financial health is in order. Ultimately, utilizing a proven financial management system and aligning yourself with an experienced partner will help you to run a better business. And, now that we’ve spent a little time looking at this topic from several angles, we thought it might be useful to sum them all up in a single review.

See below for the highlights of our 5 part blog series on Tips for Healthy Financial Management.

Tip 1: Make Managing Your Finances A Breeze

Whether it’s the accounting department at month end close, or the marketing team working up an advertising budget, having the right information when you need it goes a long way to getting tasks done on time and with confidence. And, better information yields better decision-making. Especially when your business is growing and money is tight, having easy-to-use dashboards and products tailored to your specific needs will help you use your data to more effectively power your business.

Tip 2: Put Your Data To Work

The volume of information every business generates is growing at an immeasurable pace. And it’s too easy to let the volume of data bog you down instead of using it to manage your business and your money more effectively. The good news? Sensible ways to put your data to work are well within reach. Don’t let Big Data be a Big Drag: choose a robust ERP that will turn all that data into Business Intelligence you can use to power your business.

Tip 3: Get the Most out of Every Dollar (Cash is King)

Who isn’t careful with their money these days? We are all doing everything we can to make every single dollar work as hard as we do. With the right system, you can make sure that you have a handle on your finances; cash flow calendars, bank reconciliation tools and even simplified ways to track A/R and collections. That’s a great way to make sure your money is working for you.

Tip 4: Use the Power of the Cloud on Your Terms

The cloud is changing the way the world does business. Are you ready to get on board? Two key advantages are accessibility and savings. The cloud has the potential to give your employees access to the data they need wherever they are. And, the scalability of the cloud means you only need to pay for what you’re using; no capital outlays for a new server room, or trying to get by on outdated software. You get the latest version, and only as much storage and usage as you require.

Tip 5: Adapt to Regulatory Requirements

Change is inevitable. And that certainly includes industry regulations. Whether your in healthcare or retail, having a system that can adapt when the rules change will be critical for keeping things moving. A flexible ERP will keep your business compliant without breaking the bank, and ongoing training will make sure the whole staff is operating by the book.

We hope you have found it helpful to examine these ways that businesses can make the most of their ERP. The truth is, this is only scratching the surface. Powerful business tools and experienced partners can be the difference between success and frustration. Take action today to find the right platform and partner to make your ERP a key part of your financial management success.